The European Sustainability Reporting Standards (ESRS) are the rules that specify the requirements for CSRD-compliant sustainability statements for European companies.

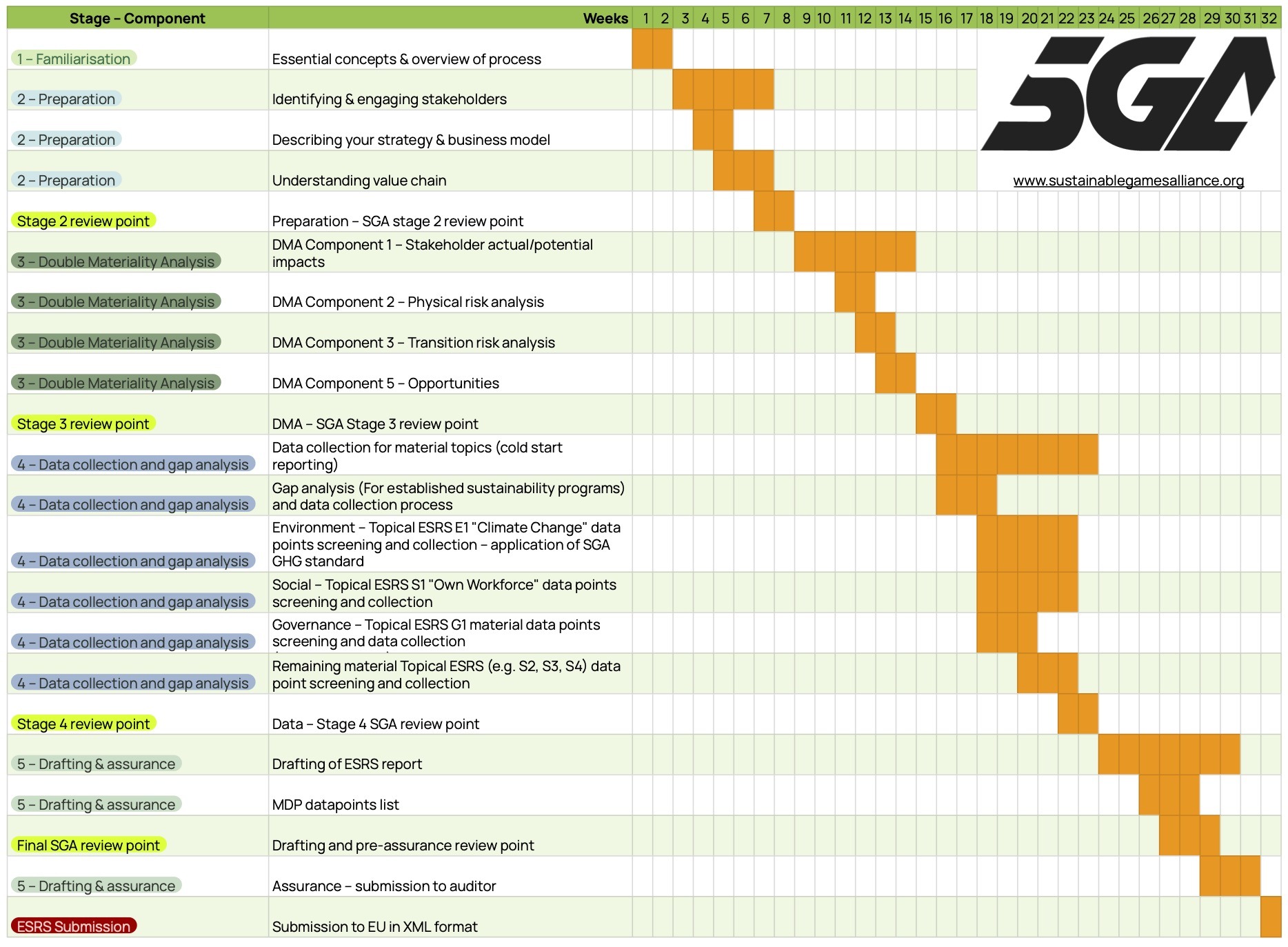

The ESRS requires an estimated 20-24 weeks depending on the size of the team, the complexity of the business, and other context. For a first-time report by an individual employee or part-time teams, plan for no less than 6 months.

The ESRS stands for the European Sustainability Reporting Standards. It is a delegated legislation that sets the rules for corporate reporting in the European Union as required by the Corporate Sustainability Reporting Directive (CSRD).

The ESRS is a complex new reporting requirement for game businesses, requiring, for example: engaging with stakeholders, undertaking analyses of the business itself, its exposure to actual and potential climate risks, and quite possibly new data collection processes that will require implementation. The process of preparing and producing an ESRS-compliant report cannot be done at short notice, and most organisations should expect no less than several months of work.

If you are already familiar with the key features and structure of the ESRS – feel free to skip down to the ESRS Roadmap heading below.

The ESRS sets the requirements for what, how, and why companies must report their actual and potential impacts on the environment and society, as well as the organisation’s governance processes to manage these impacts. The goal of this process is to align business strategy, policies and production processes with the EU’s vision of a sustainable transition.

A key feature of the ESRS is that it does not require specific behaviours or actions from organisations – like reductions in business output or sales – it only specifies required disclosures, leaving decisions about what actions, strategies, policies and approaches to take up to each organisation.

While the ESRS is relatively “hands-off” in what to do, the SGA is “hands-on” and can help game businesses identify and adopt best practices. The SGA standard will also provide methodological guidance for the E1 “Climate Change” ESRS component, a highly complex topic that most game companies have little experience with, eliminating risks of under-reporting and minimising compliance hurdles.

The ESRS is divided into 3 sections of varying length and complexity. In the ESRS delegated legislation itself, each section contains an appendix and “application requirements” that must be considered in certain circumstances when completing specific disclosures. Initial sections of the ESRS apply to every reporting entity and describe the concepts and key ideas informing the ESRS, later sections specify mandatory disclosures for all reporting entities, and the final sections determine specific topic-based disclosures that the reporting entity must decide for itself whether they are material – depending on your circumstance or situation, they may or may not be required. Complicating things further, some sections have a phased-in period for disclosures, and an initial opt-out window for certain first-time preparers.

If this sounds overwhelming – it certainly can be. However, the SGA is here to help you understand the requirements for your organisation.

Expand the boxes below for more details on the contents of each section.

The first “ESRS 1” is a set of core concepts that ESRS preparers should familiarise themselves with and refer back to when completing reporting. The SGA can provide guidance and training on these concepts.

The second “ESRS 2” is a series of mandatory disclosures every reporting entity must complete. These include: basic information about the organisation (BP1&2); how it manages environmental and social risks (GOV1-4); its business model and strategy touching on issues important to stakeholders and material risks across its entire value chain (SBM1-3); its processes and procedures to evaluate and address impacts, risks and opportunities from the green transition (IRO1-3); and a series of minimum disclosure requirements on policies (MDR–P), actions (MDR-A), metrics (MDR-M) specific targets to measure and track effectiveness (MDR-T).

The third part is a series of “topical ESRS” covering different types of Environmental impacts (E1-5), Social impacts (S1-4), and Governance (G1) disclosures. Most companies will have to complete some but not all sub-topics on specific issues (for example Topical ESRS E4 “Water and Marine Resources” is unlikely to be required for all but the largest game businesses) depending on whether the organisation has actual or potential material impacts in that area. A few topical ESRS sub-topics are mandatory and must be completed by all organisations, such as “ESRS E1 Climate Change” and “ESRS S1 Own Workforce”.

The ESRS also has provisions for sector-specific disclosures for high-impact industries. These are still in development (by EU institutions), and likely several years away at the earliest. They may also not be relevant to the games industry, intended more for industries like cement, chemicals, aviation and agriculture.

These could, however, impact game industry partners such as IT and other service providers, potentially adding future requirements at a future date. An SGA standard would pre-empt much of the requirements of a sector-specific ESRS standard.

So you want to know where to start, and what you need to do to comply with the CSRD – what’s the process for reporting according to the ESRS? The ESRS itself does not provide a clear step-by-step guide, as it is presented in a format that is mainly for “legal” purposes and as it is full of complex technical language that is not easy for most to comprehend. You can always read the actual text of the document on the European Commission website as it forms the official rules of the ESRS and are legally binding. However the official text is hundreds of pages long, so many people rely on third-party explanations and guides. EFRAG is the only official EU organisation responsible for explaining the ESRS and how to apply it. EFRAG has a number of “implementation guidance documents” which are extremely useful, and a Q&A platform to answer some of the more specific technical questions.

The SGA has been working hard to understand the requirements of the ESRS guided by the text of the ESRS legislation, the EFRAG implementation guidance and EFRAG Q&A platform. Informed by this, and by the experience of ESG experts who are implementing the ESRS at their own game businesses, we have produced the following roadmap for game companies. Given the complexity of the legislation and implementing it (especially for the first time), we have done our best to keep it as simple as possible without missing essential details that might matter to your organisation, however, if in doubt, the ESRS text itself and official EFRAG guidance documents should take precedence over SGA advice. We will do our best to correct any mistakes or omissions made known to us. Please get in touch if you see or even suspect an issue with any part of the SGA ESRS roadmap.

The SGA understanding of how companies should progress through the ESRS reporting process involves five stages. Detailed instructions for each stage can be found by following the links to SGA resources designed for game businesses to achieve the outcomes required by this complex legislation. This main page provides a high-level overview, and some key summaries, click through to the associated subpage for the full instructions.

Duration: 2-3 Weeks.

Training the person(s) responsible for ESRS reporting on new and expanded concepts and terms the ESRS introduces. These terms are: Double Materiality, Due Diligence, Stakeholders, Value Chain, and “Characteristic of Information”. Double materiality is a new term, a way of thinking about risks and opportunities for businesses – and is the heart of the ESRS.

The SGA provides a 90-minute training session for members to get up to speed on these key terms and also suggests additional reading to familiarise them with the basics of the ESRS.

For more detailed instructions for this stage, and links to SGA resources see the Stage 1 – ESRS Core Concepts page.

Traditional financial materiality is concerned with factors that might impact the bottom line of the organisation. This might be increased costs of resources, the entity’s position in the market, its brand and reputation, or its capacity to develop new products and services.

Double materiality means considering these elements as well as the impacts that the organisation has on the environment, society and others. For games businesses, this might mean impacts like the emission of greenhouse gasses, the production of waste, the impact on employees of culture and policy in the workplace, and the particular monetization strategies and impacts on vulnerable gamers, like children.

The ESRS has an entire appendix (ESRS 1, Appendix B) dedicated to how preparers should think about the qualitative characteristics of “information”. This may seem like an academic exercise, but the ESRS requires an expansive understanding of what “matters” that encompasses all potential users of ESG information that might not have been previously considered.

In brief, disclosures must be completed primarily with “relevance and faithful representation” in mind, and information is considered relevant “when it may make a difference in the decisions of users under a double materiality approach”.

There are also requirements that specify information is disclosed in a way such that it enables “comparability, verifiability and understandability.” For games companies, this means disclosing information in similar or comparable ways to other companies – this is made much simpler and easier with adoption of the SGA Standard.

Due diligence describes the processes that an organisation uses to manage, minimise, and respond to risks – including the ESRS preparation process. Importantly, the “ESRS do not impose any conduct requirements in relation to due diligence” (ESRS 1.4.58) – you do not have to change any existing due diligence process (though you might find you want to after preparing for the ESRS). Organisations are only required to disclose their processes.

There are many resources that describe and inform best practices for business due diligence – in particular, the OECD due diligence guidelines, which the SGA ESRS roadmap will refer to in our guidance.

The ESRS takes an expansive view of who or what a stakeholder is. It introduces two types. The first is affected stakeholders such as “individuals or groups whose interests are affected or could be affected – positively or negatively” by the organisation and its activities. The second type of stakeholders are users of sustainability statements. This includes familiar groups like existing or potential investors, lenders, analysts, asset managers, and so on. But it also means parts of civil society, business partners and suppliers, trade unions, NGOs, academics, researchers and any other organisations that use or rely on accurate sustainability information.

A core requirement of the ESRS is to treat the boundaries of sustainability reporting in the same way as financial reporting, and this extends the requirement to make sustainability assessments and disclosures cover the “direct and indirect business relationships in the upstream and/or downstream value chain”.

This does not necessarily mean listing every actor in the entire value chain of the production of your game, however. What it obliges organisations to do is consider the entire value chain and – particularly regarding impacts, risks and opportunities – include value chain actors in your disclosures about material issues on this subject.

It might mean considering and disclosing the impacts of using a new service provider, or it might mean considering and disclosing the sustainability risks associated with expanding development to a new hardware platform with higher end-user energy consumption. It could also mean reporting the opportunities from switching to moving to more energy–efficient offices.

For more detailed instructions for this stage, and links to SGA resources see the Stage 2 – Preparation page (in progress).

Duration: 4-5 weeks.

Stage two involves several hands-on preparatory activities, including desk research and initial descriptions of the key features of the business.

It begins with identifying and engaging with stakeholders – such as investors, key suppliers, industry partners, platforms, customers and sustainability experts. Organisations are required to engage with stakeholders to identify material topics and issues for stakeholders that can affect, or be affected, by the organisation. Stakeholder engagement will likely vary by group, and take the form of surveys, focus groups, and discussions with different stakeholders.

At the same time, ESRS preparers will start to formulate an understanding of the organisation’s strategy and business model, and also map the value chain that supports your production process. Describing these enables the identification of material sustainability issues that will and can potentially arise.

Additionally, we recommend examining existing due diligence processes during this stage to make sure they are in line with recommendations for best practices, as these will also need to be described during the reporting process.

Duration: 6-8 weeks.

With stakeholders identified and an understanding of the main material topics that will and can affect them, the double materiality analysis (DMA) can now be undertaken. This process involves analysis of identified issues, combined with other known sustainability issues and topics facing the business arising from environmental and social issues as identified by the knowledge produced in Stage 2, by expert input, and by ESRS preparers knowledge of the business.

The DMA process produces from the list of material topics facing the organisation, a series of actual and potential impacts, risks and opportunities facing the organisation. This includes negative and positive impacts on both people and planet, risks to be managed by the organisation, and opportunities to make the most of or benefit from the transition to a sustainable economy.

The SGA provides templates for undertaking each aspect of the DMA process, links to climate risk analysis tools to identify physical risks and expert advice on interpreting impacts, as well as access to the SGA network of ESG experts to identify opportunities for business in a changing climate.

For more detailed instructions for this stage, and links to SGA resources see the Stage 3 – Materiality and Impact Analysis page (coming soon)

For more detailed instructions for this stage, and links to SGA resources see the Stage 3 – Materiality and Impact Analysis page (coming soon).

Duration: 4-8 weeks.

For companies with existing sustainability processes or a history of ESG reporting, a gap analysis may be useful to identify the remaining processes and data sources that need to be collected, following the outcome of the DMA. For cold-start ESRS reporting, this process may take longer, with all new processes for data collection required. In both cases, a list of required disclosures for material topics is produced, including the topical ESRS areas that are material (based on the outcome of the previous steps), and data collection of the necessary data points and narrative disclosures can begin.

The SGA provides gap analysis and data collection guidance for environmental data. SGA GHG standard methodologies also contain process guidance and data collection protocols for environmental impacts that may be new to many game businesses. Following SGA GHG Standard methodologies also ensures the comparability and relevance of disclosures – a key objective of the ESRS.

Duration: 6-7 weeks

The final stage involves drafting the sustainability statement, following the required structure and tagging for digital submission to EU and inclusion in annual reports. The structure of the reporting includes: common disclosures, plus specific material issues and associated data points as identified in step 3, applying the data collected in step 4. ESRS-compliant reports must contain sections for identified material Environment, Social, and Governance disclosures.

Lastly, assurance is to be obtained through the usual company auditor. Once signed off, the sustainability report can be submitted to the EU digital reporting platform.

For more detailed instructions for this stage, and links to SGA resources see the Stage 3 – Materiality and Impact Analysis page (coming soon).

Note: This timeline indicates the total duration only and is meant to illustrate the approximate proportion and duration of each main stage. These are estimates, and the SGA will work with you to plan your own timeline for your specific circumstance.

Join the SGA or get in touch to talk about what else we can do for you.